Archived GMP blog page with graphs last updated on Dec 20 and Dec 27, 2024

The blog page is monitoring whether trends are persisting. Therefore the graphs posted here are showing daily observations year-to-date or with a 6 months time horizon. For the long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative

to the Mar 2020 trough and the 2020-24 highs)

Last | Up-Min | Min | Max | Down Max | Relative Strength | ||

|---|---|---|---|---|---|---|---|

Gold | 2622.4 | 78.2% | 1471.4 | 2786.9 | -5.9% | 87% | On date |

HUI | 280.0 | 71.0% | 163.7 | 363.9 | -23.0% | 58% | Dec 20, 2024 |

HUI/Gold graph

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

| ||

|

Canadian Gold and Silver Mining indices

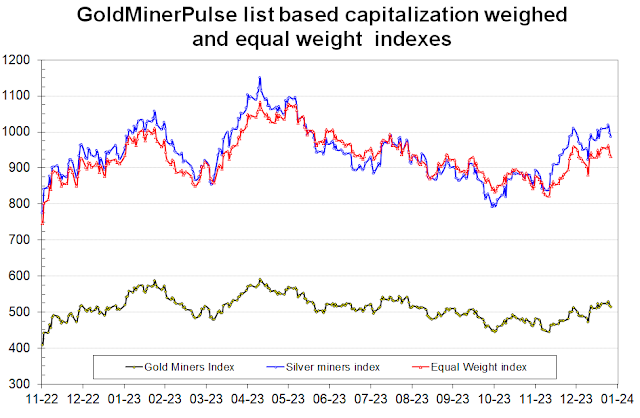

How gold miners are performing is shown by the capitalization weighed gold miners index of stocks included in the Gold Miner Pulse database (yellow diamond symbols). Note that most quotes are in CAD, which has been fluctuating to the USD. The blue graph shows the GMP silver miners index. The long term depreciation of the CAD mitigated miner loss during the gold miner bear market.

The silver mining index has been the first to break above parity, despite silver lagging gold since we started over 10 years ago. Silver miners recovered from their winter 2021/22 downturn and have been hopping 'above parity' and sliding back below several times before breaking out.

|

| GMP list based (and capitalization weighed) gold (yellow dots), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010 (click to enlarge) |

Note that the index calculation always is compensated for composition changes.

Performance graph

The performance disparity among the gold and silver miners of the GMP database is striking. Several laggards seem moribund. The median (or middle) miner (with an equal number better and worse) is still losing 39.7%: a 66% rally is needed before breaking even. However, the average stands at a 60.4% gain. The performance distribution is slanted towards the high gains.

|

| GMP Miners sorted by loss to gain since inception on Nov 19, 2010. Note that the top miners are left out to avoid excessive scale expansion Click to enlarge |

There are 17 miners/explorers losing 90% or more, with 11 thereof down over 95%. At the opposite side 34 miners are quoting above their Nov 2010 mark, led by Filo Mining; 22 stocks have doubled. Most elite miners are omitted in the above graph to avoid excessive scale expansion, but you find those in full detail below:

|

| GMP elite miners, sorted by gain since starting observations in Nov 2010 (logarithmic view with ticks 100% apart. These miners have more than doubled; click to enlarge |

A more detailed analysis including list composition changes, is found on the page "miners performance". The miners included in the database are classified in five performance quintiles. This allows evaluating how individual miners went with the herd or against the grid.

The contributor driven explorer and (junior) mining spreadsheet

Pooling efforts with any cooperative peers out there, I started the “contributor driven explorer and junior mining spreadsheet” end 2011. The idea is to get a selection of explorers, junior or mid-tier producers of gold and/or silver. This spreadsheet is updated monthly. Sector benchmarks (ETF's) were added since the very start.

Related blog articles

Several more detailed articles focusing on the longer term have been published. These are using the same approach as this blog page and still are a good read to grasp the historic perspective:- Miners relative to precious metals: a tactical approach; (July 2, 2012)

- Miners relative to precious metals: An update on 2012; (Jan 13, 2013)

- Anatomy of a gold miner bear market (Dec 30, 2013)

- Three year slide of precious metal miners (Dec 31, 2014)

- Gold miner bear market starting its fifth year (Jan 3, 2016)

- Precious metal miners relative to metal prices (Dec 31, 2016)

- Precious metal mining in 2018: a dark cloud with a silver lining and 2019 outlook (29 Dec 2018)

- Gold Miner Pulse 2019 (half-year update) (Jul 1, 2019)

- Precious metal and miner 2019 overview and outlook for 2020. (Dec 31, 2019)

- Gold Miner Pulse - Friday March 13 (Mar 13, 2020)

- Gold Miner Pulse - October 2020 update (Oct 10, 2020)

Archived GMP page with graphs last updated on Dec 29, 2023

Publication policy: This extended version includes long term data. It is not going to be updated regularly. Fresh updates are posted (twice a month) on the (shorter) gold miner pulse page. Previous releases of these detailed studies are kept in an archive.

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative to the Mar 2020 trough and the 2020-23 highs)

Last | Up_Min | Min | Max | Down_max | Relative Strength | ||

Gold | 2062.2 | 40.2% | 1,270.4 | 2,077.2 | -0.7% | 98% | on date: |

HUI | 243.3 | 48.6% | 147.6 | 363.9 | -33.1% | 40% | 12/29/2023 |

HUI/Gold graph

|

| HUI index relative to Gold over the last 6 months; the short (blue) moving average is over 50 days while the long moving average (red) is over 200 days, click to enlarge |

How we got there:

Previous longer term and mid-term review has been posted on Jun 30: Gold Miner Pulse (archive)

The situation back then:

Gold started 2023 in an uptrend just over $1800/Oz, the rally would soon stall at $1950 and by early February, the yellow metal weakened again. Even though the metal upheld $1800 well, most gains from the 2022 year-end rally, which carried through until end January vaporized. HUI/Gold bottomed on March 9, with the HUI at 211 even though gold kept firm at $1830/Oz. Less than a month later, on April 3, the yellow metal would break above $2000/Oz. No euphoria followed like on previous occasions. After the double top excursion above the symbolic $2000 threshold, gold weakened in the latter half of May and in June. However it upheld $1900/Oz. The HUI/Gold ratio slid nevertheless close to the level observed when gold was in the mid $1800's in February and March.

HUI/Gold ratio over the last 12 months:

|

| HUI index relative to Gold over the last 12 months; the short (blue) moving average is over 50 days while the long moving average (red) is over 200 days, click to enlarge |

And since:

The yellow metal strengthened until after mid July with miners following suit. Summer doldrums only started later on but there was no seasonal autumn rally. Gold eventually weakened and slid below $1900/Oz to bottom at $1860 on Oct 10. Miners were pummeled with the HUI index down to 199.1 on Oct 4. The gold recovery was swift with the metal rallying a first time to $2000 on Oct 27. One month later $2000 gold would be on the chart again determined to become the new norm. With only two NYMEX closes below $2000 ever since and one intraday peak above $2100. Not much enthusiasm among miners, with the HUI/Gold ratio barely up from its low, the HUI index is closing 2023 at 243.3. Gold is up 13% over the year eclipsing the poor 5.9% advance of the HUI.

Longer term graph

The below long term HUI/Gold graph proves that - over the last three years - there was a net loss in relative miner valuation, though the yellow metal advanced 8% over the below graph. Gold was in an uptrend until summer 2020 when it hit its all time high. The uptrend broke in autumn 2020, though miners started really diverging from gold only in the summer of 2021 when inflation started rising. The start of the Ukraine war was only a temporary tailwind interrupting the slide of valuations.

The HUI/Gold regression: a linear but non-proportional relationship between HUI and Gold puts HUI/Gold (or for that purpose Gold/XAU) as valuation parameter in a different perspective. The HUI index has been calculated since 1996.

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

SIL/Silver graph

|

Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 6 months. Click to enlarge |

How we got there:

Situation from summer 2020 till end 2022.

Silver lost more than gold immediately after reaching its $30/oz peak in summer 2020. While its price mostly remained between $20 and $25 till summer, we did experience silver weakness during late August and throughout much of autumn. Silver briefly dipped below $18 by end Aug/beginning of Sep.

Nevertheless the white metal recovered in tandem with gold, eventually even ending modestly up (2.9%) over 2022. The prolonged valuation decline of silver miners over 2022 was not silver price driven. Silver would initially hold up well early 2023 but then slide as gold weakened. The recovery March recovery rally brings silver back to $24.08 on March 31. The price barely changed over the quarter. The short 50 d moving average of the SIL/Silver ratio is now moving sideways. The long 200 dma still shows the past 2022 decline.

SIL/Silver ratio over the last year:

|

Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 12 months. Click to enlarge |

Silver started 2023 just short of $24/Oz and would uphold this level while gold was strengthening during January. Weaker silver prices in February and March did not cause a major slide, as silver upheld $20/Oz. Parallel with the gold recovery, silver would eventually break above $26/Oz early April. As it came off its peak, silver miners sold off, despite only moderate losses for the metal, ending the first half of 2023 at $22.76. The July rally brought silver back to $25. As gold retreated, so did silver: we saw $20.90 before the downtrend was broken. The gold rally inspired silver only little. We end the year at $23.78, down 0.8% over the year. Nevertheless, the SIL/silver ratio advanced significantly over the last month. Note that most silver miners have important other revenue streams: from gold, copper or other non-ferro metals.

SIL/Silver ratio over the last three years (weekly observations):

|

Global-X Silver Miners ETF, SIL relative to silver bullion; Weekly observations over 3 years. Click to enlarge |

Over the complete observation period, silver is down from $26.37/Oz to $23.78/oz. Miners slid accordingly, though on the shorter graphs it seems a slide in slices. Only in December did the SIL/Silver ratio significantly break above its 26 weeks moving average, which halted its downtrend.

Canadian Gold and Silver Mining indices

How gold miners are performing is shown by the capitalization weighed gold miners index of stocks included in the Gold Miner Pulse database (yellow diamond symbols). Note that most quotes are in CAD, which has been fluctuating to the USD. The blue graph shows the GMP silver miners index. The long term depreciation of the loonie mitigated the miner loss during gold miner bear market.The silver mining index was the first to break above parity, despite silver about flat from where we started over 10 years ago. After the June top, a lengthy slide brought the silver index back to 800. Ultimately the Christmas rally brought us back to 1000.

|

| GMP list based (and capitalization weighed) gold (yellow dots), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010 (click to enlarge) |

Note that the index calculation always is compensated for composition changes.

How we got so deep into trouble is best illustrated when showing a long term graph (2010-17) of those capitalization weighted miners indices. The revival after late Jan 2016 healed the last leg down of the miner bear market. We briefly topped the May 2013-Oct 2014 trading range.

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

Mid term graphs:

|

| Mid term graph of the GMP list based indexes from Jan 2020 till end Dec 2023 |

Gold miners indexes are back to their pre COVID levels, when the metal prices were still substantially lower than where they currently are. This has translated into much lover relative valuations. The equal weight index progressed more, reflecting the outperformance of some juniors and the take-over of some junior and mid-tier miners. Silver miners also did better despite the metal not convincing but still up from the $18 where we started in Jan 2020.

Performance graph

There is an important performance disparity among the gold and silver miners of the GMP database. Several laggards seem moribund. The median (or middle) miner (with an equal number better and worse) is now losing 57.17%: more than a double is needed to break even. The average emerged from the red now posting a 4.13% gain. The performance distribution is slanted towards the few high gains.

|

| GMP Miners sorted by loss to gain since inception on Nov 19, 2010. Note that the top miners are left out to avoid excessive scale expansion Click to enlarge |

There are 20 miners/explorers losing 90% or more, with 11 thereof down over 95%. At the opposite side 31 miners are quoting above their Nov 2010 mark, 14 stocks have doubled. The top 11 miners are omitted in the above graph to avoid excessive scale expansion, but you find the top-15 in full detail below:

|

| GMP elite miners, sorted by gain since starting observations in Nov 2010 (logarithmic view with ticks 10% apart in the first decade and 100% in the top decade). Click to enlarge |

The contributor driven explorer and (junior) mining spreadsheet

Pooling efforts with any cooperative peers out there, I started the “contributor driven explorer and junior mining spreadsheet” end 2011. The idea is to get a selection of explorers, junior or mid-tier producers of gold and/or silver. This spreadsheet is updated weekly. Sector benchmarks (ETF's) were added since the very start

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative to the Mar 2020 trough and the 2020-23 highs)

Previous longer term and mid-term review has been posted on Mar 31: Gold Miner Pulse (archive)

The situation back then:

The yellow metal continued strengthening in January, eventually topping out on Feb 1 at $1950. The decline throughout February only got to $1811, followed by a lackluster first week into March. It wrecked havoc among miners with the HUI plunging to 211 on March 9 despite gold well off its low at $1830. The HUI/Gold ratio dipped to 0.115. Hard to imagine that gold would rally close to $2000 in little more than a week. Eventually we end the quarter at $1969.7 with the HUI at 256.2. The HUI/Gold ratio crept to a still meager 0.13, barely up over the year, despite the 8% net gain in gold.

HUI/Gold ratio over the last 12 months:

|

| HUI index relative to Gold over the last 12 months, click to enlarge |

And since:

Gold started 2023 in an uptrend just over $1800/Oz, the rally would soon stall at $1950 and by early February, the yellow metal weakened again. Even though the metal upheld $1800 well, most gains from the 2022 year-end rally, which carried through until end January vaporized. HUI/Gold bottomed on March 9, with the HUI at 211 even though gold kept firm at $1830/Oz. Less than a month later, on April 3, the yellow metal would break above $2000/Oz. No euphoria followed like on previous occasions. After the double top excursion above the symbolic $2000 threshold, gold weakened in the latter half of May and in June. However it upheld $1900/Oz. The HUI/Gold ratio slid nevertheless close to the level observed when gold was in the mid $1800's in February and March.

Longer term graph

The below long term HUI/Gold graph proves that - over the last three years - there was a net loss in relative miner valuation, though the yellow metal is on balance almost flat over the below graph. Gold was in an uptrend until summer 2020 when it hit its all time high. The uptrend broke in autumn 2020, though miners started really diverging from gold only in the summer of 2021 when inflation started rising. The Ukraine war was only a temporary tailwind interrupting the slide of valuations.

|

| HUI index relative to Gold: weekly observations over the last 3 years leading into June 2023, click to enlarge |

The blue moving average line is over half a year (26 weeks) while the red long term moving average is over 2 years (104 weeks).

The HUI/Gold regression: a linear but non-proportional relationship between HUI and Gold puts HUI/Gold (or for that purpose Gold/XAU) as valuation parameter in a different perspective. The HUI index has been calculated since 1996.

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

SIL/Silver graph

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 6 months. Click to enlarge |

How we got there:

Situation from summer 2020 till end 2022.

Silver lost more than gold immediately after reaching its $30/oz peak in summer 2020. While its price mostly remained between $20 and $25 till summer, we did experience silver weakness during late August and throughout much of autumn. Silver briefly dipped below $18 by end Aug/beginning of Sep.

Nevertheless the white metal recovered in tandem with gold, eventually even ending modestly up (2.9%) over 2022. The prolonged valuation decline of silver miners over 2022 was not silver price driven. Silver would initially hold up well early 2023 but then slide as gold weakened. The recovery March recovery rally brings silver back to $24.08 on March 31. The price barely changed over the quarter. The short 50 d moving average of the SIL/Silver ratio is now moving sideways. The long 200 dma still shows the past 2022 decline.

SIL/Silver ratio over the last year:

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 12 months. Click to enlarge |

Silver started 2023 just short of $24/Oz and would uphold this level while gold was strengthening during January. Weaker silver prices in February and March did not cause a major slide, as silver upheld $20/Oz. Parallel with the gold recovery, silver would eventually break above $26/Oz early April. As it came off its peak, silver miners sold off, despite only moderate losses for the metal, ending the first half of 2023 at $22.76. The SIL/Silver ratio now posts lower than it did in Nov 2022 when silver slid to $18/Oz !

SIL/Silver ratio over the last three years (weekly observations):

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Weekly observations over 3 years. Click to enlarge |

Over the complete observation period, silver is up from $18/Oz to $22.76/oz, though a peak to $30/Oz was reached early on in the graph. Miners were not impressed: we notice a long term downtrend, though on the shorter graphs it seems a slide in slices.

Canadian Gold and Silver Mining indices

How gold miners are performing is shown by the capitalization weighed gold miners index of stocks included in the Gold Miner Pulse database (yellow diamond symbols). Note that most quotes are in CAD, which has been fluctuating to the USD. The blue graph shows the GMP silver miners index. The long term depreciation of the loonie mitigated the miner loss during gold miner bear market.The silver mining index was the first to break above parity, despite silver about flat from where we started over 10 years ago. It only just now broke back above 1000 after a slump from February with a double dip around Feb 24 and March 9.

|

| GMP list based (and capitalization weighed) gold (yellow dots), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010 (click to enlarge) |

Note that the index calculation always is compensated for composition changes.

How we got so deep into trouble is best illustrated when showing a long term graph (2010-17) of those capitalization weighted miners indices. The revival after late Jan 2016 healed the last leg down of the miner bear market. We briefly topped the May 2013-Oct 2014 trading range.

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

Mid term graphs:

|

| Mid term graph of the GMP list based indexes from Jan 2020 till end June 2023 |

Miners indexes are back to their pre COVID levels, when the metal prices were still substantially lower than where they currently are. This has translated into much lover relative valuations.

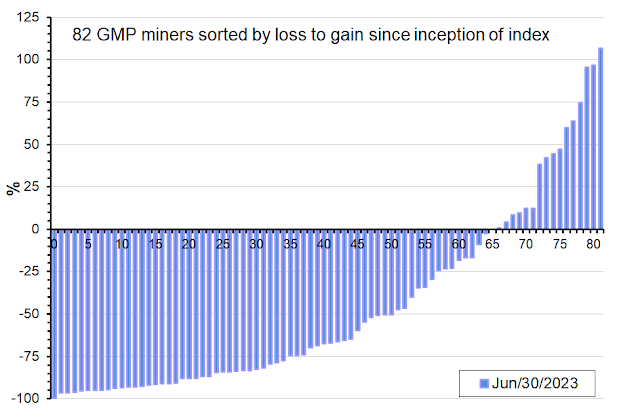

Performance graph

There is an important performance disparity among the gold and silver miners of the GMP database. Several laggards seem moribund. The median (or middle) miner (with an equal number better and worse) is now losing 53.3%: more than a double is needed to break even. The average emerged from the red now posting a 5.9% gain. The performance distribution is slanted towards the few high gains.

| |

|

There are 19 miners/explorers losing 90% or more, with 6 thereof down over 95%. At the opposite side 28 miners are quoting above their Nov 2010 mark, 13 stocks have doubled. The top 12 miners are omitted in the above graph to avoid excessive scale expansion, but you find those top-12 in full detail below:

A more detailed analysis including list composition changes, is found on the page "miners performance". The miners included in the database are classified in five performance quintiles. This allows evaluating how individual miners went with the herd or against the grid.

The contributor driven explorer and (junior) mining spreadsheet

Pooling efforts with any cooperative peers out there, I started the “contributor driven explorer and junior mining spreadsheet” end 2011. The idea is to get a selection of explorers, junior or mid-tier producers of gold and/or silver. This spreadsheet is updated weekly. Sector benchmarks (ETF's) were added since the very start.

Related blog articles

Several more detailed articles focusing on the longer term have been published. These are using the same approach as this blog page and still are a good read to grasp the historic perspective:- Miners relative to precious metals: a tactical approach; (July 2, 2012)

- Miners relative to precious metals: An update on 2012; (Jan 13, 2013)

- Anatomy of a gold miner bear market (Dec 30, 2013)

- Three year slide of precious metal miners (Dec 31, 2014)

- Gold miner bear market starting its fifth year (Jan 3, 2016)

- Precious metal miners relative to metal prices (Dec 31, 2016)

- Precious metal mining in 2018: a dark cloud with a silver lining and 2019 outlook (29 Dec 2018)

- Gold Miner Pulse 2019 (half-year update) (Jul 1, 2019)

- Precious metal and miner 2019 overview and outlook for 2020. (Dec 31, 2019)

- Gold Miner Pulse - Friday March 13 (Mar 13, 2020)

- Gold Miner Pulse - October 2020 update (Oct 10, 2020)

* * *

Archived GMP page with graphs last updated on Mar 31, 2023

Publication policy: This extended version includes long term data. It is not going to be updated regularly. Fresh updates are posted (twice a month) on the (shorter) gold miner pulse page. Previous releases of these detailed studies are kept in an archive.

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative to the Mar 2020 trough and the 2020-22 highs)

Previous longer term and mid-term review has been posted on Dec 30: Gold Miner Pulse (archive)

The situation back then:

The gold rally at the start of the war in Ukraine proved short lived. Throughout the summer of 2022, gold prices have been weakening on account of higher short term FED funds rates which also drove up the 10 year treasury rates. Bonds were pummeled. Gold ended June 2022 at $1807.5. The $18xx handle didn't hold very long: on July 5 followed a sell off with the metal dropping 2.3% to $1765.5. The sell-off didn't stop there. $1700 would be pierced several times to the downside. The first single close at $1696.5 already followed on July 20. Meanwhile $1800 started being a resistance for intermittent gold rallies. By mid September, gold would remain weaker with prices meandering below $1700/Oz for two weeks. Even $1700 proved hard to hold in October. For an entire month the yellow metal remained under $1700, with a bottom at $1628 on Oct 20. Gold recovered only gradually afterwards, meandering between $1700 and $1800 till Christmas. A late rally brought the metal back to where it started off in 2022. Miners continued suffering with the HUI index dropping precipitously and even breaking below its June 1996 level. Several stretches of HUI closes below 200 were indicative of disbelief in the future of gold mining (and exploration even more so). The HUI:Gold ratio made quadruple dips from mid September to early November (though the mid Oct dip was more shallow.) From a deeply oversold stance, miners eventually revived in November and December. The 50 dma bent up with the HUI/Gold now in a narrowing wedge capped by the still declining 200 dma. Nevertheless, the HUI miners index ends the year down 11.25%.

and since:

The yellow metal continued strengthening in January, eventually topping out on Feb 1 at $1950. The decline throughout February only got to $1811, followed by a lackluster first week into March. It wrecked havoc among miners with the HUI plunging to 211 on March 9 despite gold well off its low at $1830. The HUI/Gold ratio dipped to 0.115. Hard to imagine that gold would rally close to $2000 in little more than a week. Eventually we end the quarter at $1969.7 with the HUI at 256.2. The HUI/Gold ratio crept to a still meager 0.13, barely up over the year, despite the 8% net gain in gold.

HUI/Gold ratio over the last 12 months:

|

| HUI index relative to Gold over the last 12 months, click to enlarge |

The below long term HUI/Gold graph proves that - over the last five years - there is no net gain in relative miner valuation, though the yellow metal was below $1250/Oz by the end of June 2017 where the below graph starts off. An uptrend in miner valuation started off in summer 2018 and upheld until summer 2020 when gold hit its all time high. The Covid crisis caused a temporary downward spike in miner relative valuations as miners leveraged down the decline of gold in March 2020. The uptrend broke in autumn 2020, though miners started really diverging from gold only in the summer of 2021 when inflation started rising. The Ukraine war was only a temporary tailwind interrupting the slide of valuations.

|

| HUI index relative to Gold: weekly observations over the last 5 years leading to end 2022, click to enlarge |

The blue moving average line is over nearly one year (50 weeks) while the red long term moving average is over almost 4 years (200 weeks).

The HUI/Gold regression: a linear but non-proportional relationship between HUI and Gold puts HUI/Gold (or for that purpose Gold/XAU) as valuation parameter in a different perspective. The HUI index has been calculated since 1996.

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

SIL/Silver graph

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 6 months. Click to enlarge |

How we got there:

Situation from early summer 2022 till end 2022.

Silver miners have been through some challenging times, exacerbating the horizontal to lower trend of the metal. SIL/Silver. Investors remain cautious not without reason: No bottom has been formed yet as every nascent recovery is quickly reversed with deeper bottoms following. The December 2022 bottom eventually marked a turn around.

SIL/Silver ratio over the last year:

| |

|

Nevertheless the white metal recovered in tandem with gold, eventually even ending modestly up (2.9%) over 2022. The prolonged valuation decline of silver miners over 2022 was not silver price driven. Silver would initially hold up well early 2023 but then slide as gold weakened. The recovery March recovery rally brings silver back to $24.08 on March 31. The price barely changed over the quarter. The short 50 d moving average of the SIL/Silver ratio is now moving sideways. The long 200 dma still shows the past 2022 decline.

Canadian Gold and Silver Mining indices

How gold miners are performing is shown by the capitalization weighed gold miners index of stocks included in the Gold Miner Pulse database (yellow diamond symbols). Note that most quotes are in CAD, which has been fluctuating to the USD. The blue graph shows the GMP silver miners index. The long term depreciation of the loonie mitigated the miner loss during gold miner bear market.The silver mining index was the first to break above parity, despite silver about flat from where we started over 10 years ago. It only just now broke back above 1000 after a slump from February with a double dip around Feb 24 and March 9.

|

| GMP list based (and capitalization weighed) gold (yellow dots), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010 (click to enlarge) |

Note that the index calculation always is compensated for composition changes.

How we got so deep into trouble is best illustrated when showing a long term graph (2010-17) of those capitalization weighted miners indices. The revival after late Jan 2016 healed the last leg down of the miner bear market. We briefly topped the May 2013-Oct 2014 trading range.

|

| Long term graph of the GMP list based (and capitalisation weighed) gold (black), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010. - Data till Dec 29, 2017 (click to enlarge) |

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

Mid term graphs:

|

| Mid term graph of the GMP list based indexes from Jan 2020 till end Jun 2023 |

Miners indexes are back to their pre COVID levels, when the metal prices were still substantially lower than where they currently are. This has translated into much lover relative valuations.

Performance graph

There is an important performance disparity among the gold and silver miners of the GMP database. Several laggards seem moribund. The median (or middle) miner (with an equal number better and worse) is now losing 54.9%: more than a double is needed to break even. The average emerged from the red now posting a 7.4% gain. The performance distribution is slanted towards the few high gains.

|

| MP Miners sorted by loss to gain since inception on Nov 19, 2010. Note that the top miners are left out to avoid excessive scale expansion Click to enlarge |

There are 17 miners/explorers losing 90% or more, with 6 thereof down over 95%. At the opposite side 29 miners are quoting above their Nov 2010 mark, 14 stocks have doubled. The top 10 miners are omitted in the above graph to avoid excessive scale expansion, but you find the top-14 in full detail below:

|

| GMP elite miners, sorted by gain since starting observations in Nov 2010 (logarithmic view with ticks 100% apart) Click to enlarge |

A more detailed analysis including list composition changes, is found on the page "miners performance". The miners included in the database are classified in five performance quintiles. This allows evaluating how individual miners went with the herd or against the grid.

The contributor driven explorer and (junior) mining spreadsheet

Pooling efforts with any cooperative peers out there, I started the “contributor driven explorer and junior mining spreadsheet” end 2011. The idea is to get a selection of explorers, junior or mid-tier producers of gold and/or silver. This spreadsheet is updated weekly. Sector benchmarks (ETF's) were added since the very start.

Archived GMP page with graphs last updated on Dec 30, 2022

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative to the Mar 2020 trough and the 2020-22 highs)

How we got there:

Previous longer term and mid-term review has been posted on Jun 24: Gold Miner Pulse (archive)

The situation back then:

In January, gold was unusually weak bottoming at $1791 on Jan 28. The much anticipated first 25 bp rate hike by the FED about coincided with gold hitting its year-to-date peak above $2000/Oz shortly after the Russian invasion in the Ukraine. Both energy and food prices rose sharply. Gold quickly slid back below $1900/Oz and kept meandering above $1800 ever since. The latest 75 bp FED rate hike was more than initially anticipated after much higher than expected CPI data had been released. Miners slid below their January bottom recently though gold still quotes higher. Material cost and wage inflation are thought to affect margins significantly.

... and since:

Throughout the summer of 2022, gold prices have been weakening on account of higher short term FED funds rates which also drove up the 10 year treasury rates. Bonds were pummeled. Gold ended June 2022 at $1807.5. The $18xx handle didn't hold very long: on July 5 followed a sell off with the metal dropping 2.3% to $1765.5. The sell-off didn't stop there. $1700 would be pierced several times to the downside. The first single close at $1696.5 already followed on July 20. Meanwhile $1800 started being a resistance for intermittent gold rallies. By mid September, gold would remain weaker with prices meandering below $1700/Oz for two weeks. Even $1700 proved hard to hold in October. For an entire month the yellow metal remained under $1700, with a bottom at $1628 on Oct 20. Gold recovered only gradually afterwards, meandering between $1700 and $1800 till Christmas. A late rally brought the metal back to where it started off in 2022. Miners continued suffering with the HUI index dropping precipitously and even breaking below its June 1996 level. Several stretches of HUI closes below 200 were indicative of disbelief in the future of gold mining (and exploration even more so.)

The HUI:Gold ratio made quadruple dips from mid September to early November (though the mid Oct dip was more shallow.) From a deeply oversold stance, miners eventually revived in November and December. The 50 dma bent up with the HUI/Gold now in a narrowing wedge capped by the still declining 200 dma. Nevertheless, the HUI miners index ends the year down 11.25%.

HUI/Gold ratio over the last 12 months:

|

| HUI index relative to Gold over the last 12 months, click to enlarge |

The HUI / Gold ratio corroborates the gold miner slump. With the yellow metal trending sideways over 2022, the long term moving average of the HUI/gold ratio continues its downward trend.

The below long term HUI/Gold graph proves that there is no net gain in relative miner valuation, though the yellow metal was below $1250/Oz by the end of June 2017 where the below graph starts off. An uptrend in miner valuation started off in summer 2018 and upheld until summer 2020 when gold hit its all time high. The Covid crisis caused a temporary downward spike in miner relative valuations as miners leveraged down the decline of gold in March 2020. The uptrend broke in autumn 2020, though miners started really diverging from gold only in the summer of 2021 when inflation started rising. The Ukraine war was only a temporary tailwind interrupting the slide of valuations.

|

| HUI index relative to Gold: weekly observations over the last 5 years, click to enlarge |

The blue moving average line is over nearly one year (50 weeks) while the red long term moving average is over almost 4 years (200 weeks).

The HUI/Gold regression: a linear but non-proportional relationship between HUI and Gold puts HUI/Gold (or for that purpose Gold/XAU) as valuation parameter in a different perspective. The HUI index has been calculated since 1996.

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

SIL/Silver graph

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 6 months. Click to enlarge |

How we got there:

Situation back in early summer 2021:

Silver miners have been through some challenging times, exacerbating the horizontal to lower trend of the metal. SIL/Silver. Investors remain cautious not without reason: No bottom has been formed yet as every nascent recovery is quickly reversed with deeper bottoms following.

SIL/Silver ratio over the last year:

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 12 months. Click to enlarge |

Silver lost more than gold immediately after reaching its $30/oz peak in summer 2020. While its price mostly remained between $20 and $25 till summer, we did experience silver weakness during late August and throughout much of autumn. Silver briefly dipped below $18 by end Aug/beginning of Sep.

Nevertheless the white metal recovered in tandem with gold, eventually even ending modestly up (2.9%) over 2022. The prolonged valuation decline of silver miners over 2022 is not silver price driven.

Canadian Gold and Silver Mining indices

How gold miners are performing is shown by the capitalization weighed gold miners index of stocks included in the Gold Miner Pulse database (yellow diamond symbols). Note that most quotes are in CAD, which has been fluctuating to the USD. The blue graph shows the GMP silver miners index. The long term depreciation of the loonie mitigated the miner loss during gold miner bear market.The silver mining index was the first to break above parity, despite silver about flat from where we started over 10 years ago.

|

| GMP list based (and capitalization weighed) gold (yellow dots), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010 (click to enlarge) |

Note that the index calculation always is compensated for composition changes.

How we got so deep into trouble is best illustrated when showing a long term graph (2010-17) of those capitalization weighted miners indices. The revival after late Jan 2016 healed the last leg down of the miner bear market. We briefly topped the May 2013-Oct 2014 trading range.

|

| Long term graph of the GMP list based (and capitalisation weighed) gold (black), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010. - Data till Dec 29, 2017 (click to enlarge) |

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

Mid term graphs:

|

| Mid term graph of the GMP list based indexes from summer 2019 till end Dec 2022 |

Miners indexes are back to their pre COVID levels, when the metal prices were still substantially lower than where they currently are. This has translated into much lover relative valuations.

Performance graph

There is an important performance disparity among the gold and silver miners of the GMP database. Several laggards seem moribund. The median (or middle) miner (with an equal number better and worse) is now losing 64.2%: almost a triple is needed to break even. The average has slid into the red for a couple of months now still posting a 2.1% loss. The performance distribution is slanted towards the few high gains.

|

| GMP Miners sorted by loss to gain since inception on Nov 19, 2010. Note that the top miners are left out to avoid excessive scale expansion Click to enlarge |

There are 16 miners/explorers losing 90% or more, with 6 thereof down over 95%. At the opposite side 26 miners are quoting above their Nov 2010 mark, 14 stocks have doubled. The top 12 miners are omitted in the above graph to avoid excessive scale expansion, but you find the top-14 in full detail below:

|

| GMP elite miners, sorted by gain since starting observations in Nov 2010 (logarithmic view with ticks 100% apart) Click to enlarge |

A more detailed analysis including list composition changes, is found on the page "miners performance". The miners included in the database are classified in five performance quintiles. This allows evaluating how individual miners went with the herd or against the grid.

The contributor driven explorer and (junior) mining spreadsheet

Pooling efforts with any cooperative peers out there, I started the “contributor driven explorer and junior mining spreadsheet” end 2011. The idea is to get a selection of explorers, junior or mid-tier producers of gold and/or silver. This spreadsheet is updated weekly. Sector benchmarks (ETF's) were added since the very start.

Related blog articles

Several more detailed articles focusing on the longer term have been published. These are using the same approach as this blog page and still are a good read to grasp the historic perspective:- Miners relative to precious metals: a tactical approach; (July 2, 2012)

- Miners relative to precious metals: An update on 2012; (Jan 13, 2013)

- Anatomy of a gold miner bear market (Dec 30, 2013)

- Three year slide of precious metal miners (Dec 31, 2014)

- Gold miner bear market starting its fifth year (Jan 3, 2016)

- Precious metal miners relative to metal prices (Dec 31, 2016)

- Precious metal mining in 2018: a dark cloud with a silver lining and 2019 outlook (29 Dec 2018)

- Gold Miner Pulse 2019 (half-year update) (Jul 1, 2019)

- Precious metal and miner 2019 overview and outlook for 2020. (Dec 31, 2019)

- Gold Miner Pulse - Friday March 13 (Mar 13, 2020)

- Gold Miner Pulse - October 2020 update (Oct 10, 2020)

Archived GMP page with graphs last updated on Jun 24, 2022

Publication policy: This extended version includes long term data. It is not going to be updated regularly. Fresh updates are posted (twice a month) on the (shorter) gold miner pulse page. Previous releases of these detailed studies are kept in an archive.

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative to the Mar 2020 trough and the 2020-21 highs)

|

Last |

Up_Min |

Min |

Max |

Down_max |

Relative Strength |

||

|

Gold |

1826.4 |

24.1% |

1,270.4 |

2,063.2 |

-11.5% |

60% |

on date: |

|

HUI |

238.0 |

45.4% |

147.6 |

363.9 |

-34.6% |

37% |

6/24/2022 |

HUI/Gold graph

How we got there:

Previous longer term and mid-term review has been posted on Dec 17: Gold Miner Pulse (archive)

The situation back then:

Gold now steaming up to $1900/Oz couldn't keep up miner enthusiasm. After that rally failed, the gold price repeatedly made excursions above $1800 only to drop back below. However the bottom set in March was never even challenged again. With the yearly US-CPI staying stubbornly high and even rising, the FED narrative of a transitory inflation surge has lost all credibility. Whereas rising inflation spurred the gold price in November, the perspective of the bond purchase program wound down more rapidly and the FED rate possibly raised three times in 2022 broke the rally. The yellow metal again quotes close to $1800 now.

... and since:

In January, gold was unusually weak bottoming at $1791 on Jan 28. The much anticipated first 25 bp rate hike by the FED about coincided with gold hitting its year-to-date peak above $2000/Oz shortly after the Russian invasion in the Ukraine. Both energy and food prices rose sharply. Gold quickly slid back below $1900/Oz and kept meandering above $1800 ever since. The latest 75 bp FED rate hike was more than initially anticipated after much higher than expected CPI data had been released. Miners slid below their January bottom recently though gold still quotes higher. Material cost and wage inflation are thought to affect margins significantly.

HUI/Gold ratio over the last 12 months:

|

| HUI index relative to Gold over the last 12 months, click to enlarge |

The HUI / Gold ratio corroborates the gold miner slump. With the yellow metal trending sideways over 2021-22, the long term moving average of the HUI/gold ratio continues its downward trend.

The below long term HUI/Gold graph proves that there is no net gain in relative miner valuation, though the yellow metal was below $1250/Oz by the end of June 2017 where the below graph starts off. An uptrend in miner valuation started off in summer 2018 and upheld until summer 2020 when gold hit its all time high. The Covid crisis caused a temporary downward spike in miner relative valuations as miners leveraged down the decline of gold in March 2020. The uptrend broke in autumn 2020, though miners started really diverging from gold only in the summer of 2021 when inflation started rising. The Ukraine war was only a temporary tailwind interrupting the slide of valuations.

|

| HUI index relative to Gold: weekly observations over the last 5 years, click to enlarge |

The blue moving average line is over one year (52 weeks) while the red long term moving average is over 3 years.

The HUI/Gold regression: a linear but non-proportional relationship between HUI and Gold puts HUI/Gold (or for that purpose Gold/XAU) as valuation parameter in a different perspective. The HUI index has been calculated since 1996.

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

SIL/Silver graph

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 6 months. Click to enlarge |

How we got there:

Situation back in early summer 2021:

Silver miners have been through some challenging times, exacerbating the horizontal to lower trend of the metal. SIL/Silver. Investors remain cautious not without reason: No bottom has been formed yet as every nascent recovery is quickly reversed with deeper bottoms following.

SIL/Silver ratio over the last year:

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 12 months. Click to enlarge |

Similar to the valuation graph for gold miners, below you find a weekly graph. The blue moving average line is over one year (52 weeks) while the red long term moving average is over 3 years.

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Weekly observations over 5 years. Click to enlarge |

Silver lost more than gold immediatly after reaching its $30/oz peak in summer 2020. However the price has remained between $20 and $25 for most of the time ever since. The steep valuation decline in 2022 is not silver price driven.

Canadian Gold and Silver Mining indices

How gold miners are performing is shown by the capitalization weighed gold miners index of stocks included in the Gold Miner Pulse database (yellow diamond symbols). Note that most quotes are in CAD, which has been fluctuating to the USD. The blue graph shows the GMP silver miners index. The long term depreciation of the loonie mitigated the miner loss during gold miner bear market.The silver mining index was the first to break above parity, despite silver about flat from where we started over 10 years ago.

|

| GMP list based (and capitalization weighed) gold (yellow dots), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010 (click to enlarge) |

Note that the index calculation always is compensated for composition changes.

How we got so deep into trouble is best illustrated when showing a long term graph (2010-17) of those capitalization weighted miners indices. The revival after late Jan 2016 healed the last leg down of the miner bear market. We briefly topped the May 2013-Oct 2014 trading range.

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

|

| Long term graph of the GMP list based (and capitalisation weighed) gold (black), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010. - Data till Dec 29, 2017 (click to enlarge) |

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

Mid term graphs:

|

| Continuation of the long term graph from 2017 till the end of 2020. |

|

| Mid/Long term graph of the GMP list based (and capitalization weighed) gold (black), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010. - Data till Jun 24, 2022 (click to enlarge) |

Miners indexes are back to their pre COVID levels, when the metal prices were still substantially lower than where they currently are. This has translated into much lover relative valuations.

Performance graph

There still is an important performance disparity among the gold and silver miners of the GMP database. Several laggards seem moribund. The median (or middle) miner (with an equal number better and worse) is now losing 62.9%: well over a double is needed before breaking even. The average has slid into the red for a couple of months now posting a 12.4% loss. The performance distribution is slanted towards the few high gains.

|

| GMP Miners sorted by loss to gain since inception on Nov 19, 2010. Note that the top miners are left out to avoid excessive scale expansion Click to enlarge |

There are 13 miners/explorers losing 90% or more, with 5 thereof down over 95%. At the opposite side 19 miners are quoting above their Nov 2010 mark, now led by Laurion Minerals Expl.; 10 stocks have doubled. The top 10 miners are omitted in the above graph to avoid excessive scale expansion, but you find the top-14 in full detail below:

| |

|

A more detailed analysis including list composition changes, is found on the page "miners performance". The miners included in the database are classified in five performance quintiles. This allows evaluating how individual miners went with the herd or against the grid.

The contributor driven explorer and (junior) mining spreadsheet

Pooling efforts with any cooperative peers out there, I started the “contributor driven explorer and junior mining spreadsheet” end 2011. The idea is to get a selection of explorers, junior or mid-tier producers of gold and/or silver. This spreadsheet is updated weekly. Sector benchmarks (ETF's) were added since the very start.

Related blog articles

Several more detailed articles focusing on the longer term have been published. These are using the same approach as this blog page and still are a good read to grasp the historic perspective:- Miners relative to precious metals: a tactical approach; (July 2, 2012)

- Miners relative to precious metals: An update on 2012; (Jan 13, 2013)

- Anatomy of a gold miner bear market (Dec 30, 2013)

- Three year slide of precious metal miners (Dec 31, 2014)

- Gold miner bear market starting its fifth year (Jan 3, 2016)

- Precious metal miners relative to metal prices (Dec 31, 2016)

- Precious metal mining in 2018: a dark cloud with a silver lining and 2019 outlook (29 Dec 2018)

- Gold Miner Pulse 2019 (half-year update) (Jul 1, 2019)

- Precious metal and miner 2019 overview and outlook for 2020. (Dec 31, 2019)

- Gold Miner Pulse - Friday March 13 (Mar 13, 2020)

- Gold Miner Pulse - October 2020 update (Oct 10, 2020)

* * * * *

Archived GMP page with graphs last updated on Dec 17, 2021

Publication policy: This extended version includes long term data. It is not going to be updated regularly. Fresh updates are posted (twice a month) on the (shorter) gold miner pulse page. Previous releases of these detailed studies are kept in an archive.

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Scope: This extended blog page is monitoring whether trends are persisting and/or how they are evolving. Therefore the graphs posted here are showing both daily observations with a 6 months time horizon and some graphs with a 3 to 4 year time horizon. For the very long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative to the Mar 2020 trough and the 2020-21 highs)

|

Last |

Up_Min |

Min |

Max |

Down_max |

Relative Strength |

||

|

Gold |

1798.7 |

22.2% |

1,471.4 |

2,063.2 |

-12.8% |

55% |

on date: |

|

HUI |

247.5 |

51.2% |

147.6 |

363.9 |

-32.0% |

42% |

12/17/2021 |

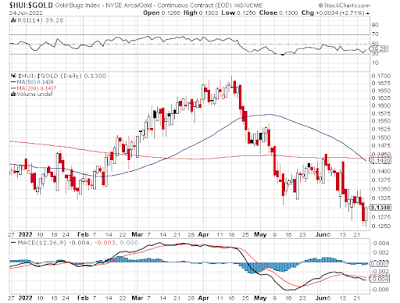

HUI/Gold graph

|

| HUI index relative to Gold over the last 6 months, click to enlarge |

How we got there:

Previous longer term and mid-term review has been posted on June 11: Gold Miner Pulse (archive)

The situation back then:

The yellow metal has bottomed after an eight months jig-saw correction. Gold miners were gradually recovering from a far oversold position. The HUI/Gold ratio started testing its 200 dma. Early May, April gains evaporated with HUI/Gold dropping through its 50 dma. Yet, miners have strengthened since gold regained $1800. HUI/Gold has moved up the narrowing wedge and broke above the 200 dma. Gold now steaming up to $1900/Oz couldn't keep up miner enthusiasm.

... and since:

After the rally failed, the gold price repeatedly made excursions above $1800 only to drop back below. However the bottom set in March was never even challenged again. With the yearly US-CPI staying stubbornly high and even rising, the FED narrative of a transitory inflation surge has lost all credibility. Whereas rising inflation spurred the gold price in November, the perspective of the bond purchase program wound down more rapidly and the FED rate possibly raised three times in 2022 broke the rally. The yellow metal again quotes close to $1800 now.

The damage among miners has been much more severe, with even the meek HUI/Gold regression (valid since summer 2018) now severely challenged. Read: Oversold Miners - Lagging Gold

The situation didn't improve since drafting that article. The divergence from the regression line even maxed at -55 (HUI points) on Oct 1. At -46.5 the reading on Dec 17 isn't much better. In order for a regression to hold, negative divergences need to alternate with positive once. The last (very modest) positive divergences were observed in the month of May.

Year-to-date HUI/Gold ratio:

|

| HUI index relative to Gold year-to-date, click to enlarge |

The HUI/Gold regression: a linear but non-proportional relationship between HUI and Gold puts HUI/Gold (or for that purpose Gold/XAU) as valuation parameter in a different perspective. The HUI index has been calculated since 1996.

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

SIL/Silver graph

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 6 months. Click to enlarge |

How we got there:

Situation back in early summer 2021:

Silver miners have been through some challenging times, exacerbating the horizontal to lower trend of the metal. SIL/Silver now regained its bending 50 dma. Investors remained cautious not without reason: Early May, April gains evaporated. A bottom has formed, with an uptrend emerging.

SIL/Silver ratio year-to-date:

|

Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations year-to-date. Click to enlarge |

The decline into spring has been remarkable, during subsequent months, the trend did not exacerbate. The early October blip (much more pronounced for gold miners) didn't last either. Nevertheless, silver declined percentage-wise more since its $30 Aug 2020 peak than did gold.

Canadian Gold and Silver Mining indices

How gold miners are performing is shown by the capitalization weighed gold miners index of stocks included in the Gold Miner Pulse database (yellow diamond symbols). Note that most quotes are in CAD, which has been fluctuating to the USD. The blue graph shows the GMP silver miners index. The long term depreciation of the loonie mitigated the miner loss during gold miner bear market.The silver mining index was the first to break above parity, despite silver about flat from where we started over 10 years ago.

| |

|

How we got so deep into trouble is best illustrated when showing a long term graph (2010-17) of those capitalization weighted miners indices. The revival after late Jan 2016 healed the last leg down of the miner bear market. We briefly topped the May 2013-Oct 2014 trading range.

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

|

| Long term graph of the GMP list based (and capitalisation weighed) gold (black), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010. - Data till Dec 29, 2017 (click to enlarge) |

The silver miners index rose till 1400 in April 2011, peaking three weeks earlier than did the silver price. The silver miners index also posted a higher maximum during both the March 2014 and June to early August recovery than it did in the August 2013 recovery. The gold miners index and the equal weight index did not peak higher at any of the failing 2014-15 recoveries than they did in August 2013. By January 2016 silver miners nearly completely lost their edge relative to gold miners, yet the recovery proved more vigorous. The below long term graph covers over three years: the end of the bear market with miners bottoming by Dec 2015, the 2016 boom-bust over the tedious months early 2018, with miners unable to match gold strengthening. Miner quotes were jittery after gold plunged below $1200. Towards end 2018 gold strengthened to $1280 with miners recovering timidly. As gold broke above its trading range late spring 2019, miners started rallying. The 2016 miners boom euphoria didn't however repeat. The 2020 miners surge was driven by a substantial rise of precious metals with gold setting a new ATH above $2060 in August.

|

| Mid/Long term graph of the GMP list based (and capitalisation weighed) gold (black), silver (blue) and equal weight (red) miners indices. Reference 1000 on Nov 19, 2010. - Data till Dec 17, 2021 (click to enlarge) |

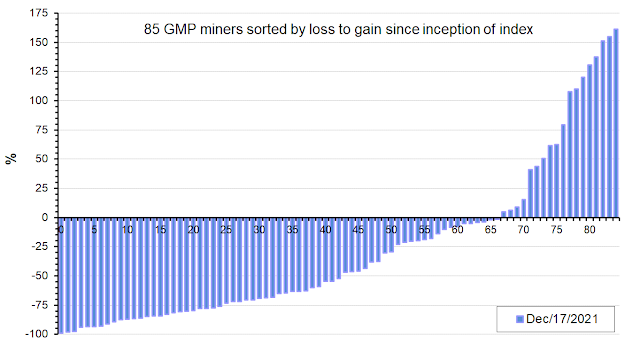

Performance graph

There is an important performance disparity among the gold and silver miners of the GMP database. Several laggards seem moribund. The median (or middle) miner (with an equal number better and worse) is losing 41.0%: still well below break even. The average is posting a 8.5% profit. The performance distribution is slanted towards the high gains.

|

| GMP Miners sorted by loss to gain since inception on Nov 19, 2010. Note that the top miners are left out to avoid excessive scale expansion Click to enlarge |

There are 8 miners/explorers losing 90% or more, with 3 thereof down over 95%. At the opposite side 27 miners are quoting above their Nov 2010 mark, now led by Aura Minerals; 17 stocks have doubled. The top 9 miners are omitted in the above graph to avoid excessive scale expansion, but you find the top-14 in full detail below:

| |

|

A more detailed analysis including list composition changes, is found on the page "miners performance". The miners included in the database are classified in five performance quintiles. This allows evaluating how individual miners went with the herd or against the grid.

The contributor driven explorer and (junior) mining spreadsheet

Pooling efforts with any cooperative peers out there, I started the “contributor driven explorer and junior mining spreadsheet” end 2011. The idea is to get a selection of explorers, junior or mid-tier producers of gold and/or silver. This spreadsheet is updated weekly. Sector benchmarks (ETF's) were added since the very start.

Related blog articles

Several more detailed articles focusing on the longer term have been published. These are using the same approach as this blog page and still are a good read to grasp the historic perspective:- Miners relative to precious metals: a tactical approach; (July 2, 2012)

- Miners relative to precious metals: An update on 2012; (Jan 13, 2013)

- Anatomy of a gold miner bear market (Dec 30, 2013)

- Three year slide of precious metal miners (Dec 31, 2014)

- Gold miner bear market starting its fifth year (Jan 3, 2016)

- Precious metal miners relative to metal prices (Dec 31, 2016)

- Precious metal mining in 2018: a dark cloud with a silver lining and 2019 outlook (29 Dec 2018)

- Gold Miner Pulse 2019 (half-year update) (Jul 1, 2019)

- Precious metal and miner 2019 overview and outlook for 2020. (Dec 31, 2019)

- Gold Miner Pulse - Friday March 13 (Mar 13, 2020)

- Gold Miner Pulse - October 2020 update (Oct 10, 2020)

* * * * *

Archived GMP page with graphs last updated on Jun 11, 2021

This extended version includes long term data. It is not going to be updated regularly.

The blog page is monitoring whether trends are persisting. Therefore the graphs posted here are showing daily observations year-to-date or with a 6 months time horizon. For the long term reference frame, see the articles referenced at the bottom.

Unhedged Gold miners relative to Gold bullion

Where are we today?

Where are we today?

(relative to the May 2019 or Mar 2020 trough and the 2020-21 highs)

Previous longer term and mid-term review has been posted end mid October: Gold Miner Pulse - October update

HUI/Gold ended 2019 on a high, but gold rising because of political tension upon the elimination of Qassem Suleimani did not inspire miners. HUI/Gold slid to and broke below its 50 dma. The Vancouver Resource Investment Conference didn't inspire any recovery either. The yellow metal convincingly breaking above $1600 curbed the trend but the Corona virus frenzy slashed miners and precious metals. HUI/Gold plunged both beneath the 50 dma and the 200 dma. The surprise 50 bp FED rate cut launched gold higher again with miners briefly bouncing despite a tepid stock market response.

The stock market slide accelerated with precious metals giving way after peaking on Monday Mar 9. Tuesday's retreat was but a prelude for the slide that was to follow resulting in the capitulation on Thursday Mar 12 followed by another slide to end that horrendous week. (The overvalued) Palladium managed to implode over 20% on Thursday. Yet also Platinum and Silver which had been lagging for years also were beaten up. Miners were slaughtered, with the HUI/Gold ratio sliding. The Mar 13 graph made previous moves of the past six months seem like grating the ceiling. HUI/Gold abruptly plunged to its dec 2015 - jan 2016 bear market bottom on March 16. The Corona virus pandemic also causes unexpected mine closures pretty much across the globe. Several miners needed to revise production forecasts downward.

Despite a Friday sell-off, miners ended the week after Easter up firmly, keeping track of the escalating gold price. HUI/Gold finally bridged the gap with the pre-Corona level, with the HUI also exceeding its 2019 late summer top by April 24. Both precious metals and miners suffered a mid-week pull back but sentiment improved on Friday May 1. Despite gold flat over the first week of May, miners progressed modestly, making HUI/Gold rise to its highest value of 2020. After meandering around $1700, gold broke out on Thursday May 14. Miners blew off steam end May, especially the majors which most enjoyed the run-up after the Corona dip. Miners were to strengthen only towards end June.

Mid July the HUI/Gold ratio broke above its mid May high, but we needed gold steaming up to $1900 to make it happen.

Gold rallied to close at a new ATH on Monday Aug 10; however miners were weakening with several missing on earnings after expectations were cranked up unreasonably high by sell side analysts. Miners don't seem to like fresh all time highs for the yellow metal nor gold recovering above $2000, since the HUI/Gold ratio is sliding in disbelief.

Though the yellow metal had been weakening in anticipation to the Jackson Hole meeting of central bankers, it came out stronger. Miners also ended the week rallying.

Precious metals have been weakening early September, leading up to Labour day. HUI/Gold more or less stayed put. Labour day didn't bring about any major shift. Gold was recovering mid September, but the rally petered out and miners were not inspired. HUI/Gold was easing little over the latter weeks of September.

A stock market relief rally upon the favorable news on the Corona vaccine caused save haven assets to slide. Apart from stocks which flourished because of the pandemic, that also included precious metals and miners. On balance, HUI/Gold also slid below its 50 dma and 200 dma. HUI/Gold started rising before the yellow metal bottomed at $1775, yet the recovery was short lived. Miners disappointed. The December gold rally inspires miners, lifting them into the narrow wedge between the declining 50 dma and the still rising 200 dma.

The December gold rally inspired miners, lifting them into the narrow wedge between the declining 50 dma and the still rising 200 dma. With a rollercoaster rally and swoon we entered 2021. From a closing high at $1950 the yellow metal slid to $1850. The 3% Friday slide may be inspired by weak employment data tampering inflation expectations. Mining investors didn't buy that story, not leveraging down the gold slide as they more often do.

The gold price end January at $1848. Miners continued their unabated descent till a capitulation on Wednesday. The activist shorter hunt, which found its main target in 'Game Stop' spread to other heavily shorted stocks, which temporarily lifted many silver and some gold miners, as the silver rally soon fizzled out. Higher than anticipated inflation previsions lift long term interest rates in USD, which in turn sent gold plummeting to $1700. Moreover, miners have been weak relative to metal prices. With HUI/Gold regaining its 50 dma, the worst seems over.

Last few weeks:

The yellow metal has bottomed after an eight months jig-saw correction. Gold miners were gradually recovering from a far oversold position. The HUI/Gold ratio started testing its 200 dma. Early May, April gains evaporated with HUI/Gold dropping through its 50 dma. Yet, miners have strengthened since gold regained $1800. HUI/Gold has moved up the narrowing wedge and broke above the 200 dma. Gold now steaming up to $1900/Oz couldn't keep up miner enthusiasm.

Global X Silver Miners ETF (SIL) relative to silver bullion

SIL/Silver graph

SIL/Silver graph

|

| Global-X Silver Miners ETF, SIL relative to silver bullion; Daily observations over 6 months. Click to enlarge |

How we got there:

Previous longer term review has been posted end December 2019: Precious metal and miner 2019 overview and outlook for 2020.

SIL/silver peaked on Dec 30, 2019. Silver miners retreated with the broad market, despite metals firming 'for the wrong reason' (violence in Iraq and political tension). SIL/silver slid below its 50 dma. Investors are disappointed that silver again lagging gold, with the Au/Ag ratio again in excess of 86. The Vancouver Resource Investment Conference didn't lead to any recovery either. Silver regaining $18 brought some improvement but the Corona virus frenzy slashed both miners and precious metals.

Who was to predict silver to slide from $18.60 to $11.65 on less than four weeks time? The abrupt slide aggravated after mid March. Silver miners imploded, reaching bear market valuation as is shown on the new graph. However as silver plunged beneath $12, miners shrugged off the extreme bearish stance and recovered with the general bear market bounce.

Silver has barely revived and the Au:Ag ratio remains extremely elevated (114 on May 1).

After extremely volatile swings, the SIL:$Silver ratio entered into an uptrend. This is illustrating the remarkable silver miner resilience.

After extremely volatile swings, the SIL:$Silver ratio entered into an uptrend. This is illustrating the remarkable silver miner resilience.

The metal ultimately rallied, regaining its loss incurred during the Corona frenzy sell-off. Nevertheless, the silver miner rally started losing steam. After precious metals again weakened early June, SIL/Silver slid beneath its rising 50 dma.