For following up on the miners I often report on, daily closing prices of all quotes do the job. But a wealth of other information can also be added.

Generally I use a portfolio kept in Yahoo to provide closing prices on a recurrent basis. For each quote, the last trading date and time come next to the last stock price, the absolute and relative daily variation, opening price, highest and lowest price over the session and volume traded are what you get in a download.

On screen you may choose the summary view, which is in fact rather extended. The yearly (rolling 52 weeks) highest and lowest price is now also added. In graphic mode, you get a tiny bar chart of where the stock price is relative to those yearly extremes. Earnings per share is one more interesting characteristic in this view.

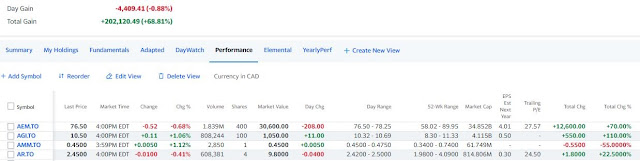

When asking for a performance view, the aggregated gain or loss since inclusion on the list are now also added.

You can make an "adapted" view where you may include the company name next to the quote, estra's such as the latest bid & ask (usually this is delayed info), the market capitalization, Price/earnings ratio and the price to book value ratio are also interesting to have ...

More of those fundamentals are shown when choosing right that: the fundamental view of your portfolio. It then includes a forward P/E estimate, latest dividend and its payment date, Trailing and forward dividend yields.

|

| Different views mentioned on top. Here the "Performance" view is selected. (click to enlarge) |

Not all views are very useful. The 'elemental' view just gives you the quote and the last price.

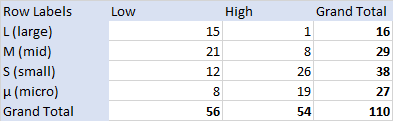

How does 'price mobility' correlate with market capitalization?

- Large cap: over $5B;

- Mid cap: between $1B and $5B;

- Small cap: between $100M and $1B

- µ : Micro cap: less than $100M

- L: Low price mobility < 50%

- H : High price mobility >= 50%

|

| 'Percentages' of 'low' and 'high' price mobility stocks as a function of Market cap size class. |

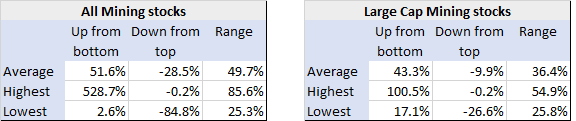

Does Market Cap size class correlate with performance?

Stock price mobility is one thing, but more important to any investor if whether it has been up or down. Therefore we add a few little tables by market cap size band (in the heading). In each case it says what was the average, the highest and the lowest value for the percentage gain since the bottom of the rolling 52 weeks, the percentage loss since the top and the range. Note that the highest gain since the bottom and the lowest loss since the top are not necessarily observations of the same mining stock.

The highest stock price mobility is generally not to the up-side among micro-cap miners. Just consider that a 69.2% price gain is needed to compensate for the average 40.9% slide from the top.

The foot-angle

Self fulfilling prophecy is why this analysis is less compelling than it may seem at first sight. A small cap of $150 M making a 50% slide from its top ends up being a micro-cap. This implies that some losers-bias gets in the way of the lowest size band. Similarly, some winners bias may creep into the highest size band, where a $7 B mining stock was definitely not a large cap yet before rallying 80% from its 52 weeks bottom. (These are only numeric examples, not specific mining stocks.) It is not a safe assumption that 'winners' and 'losers' bias is cancelling out for the intermediate market cap size bands.

Historic versus recent performance

- We have seen the mega-mergers of a few years ago, which raise the question as of which component to follow prior to the merger.

- Further on there have been numerous other acquisitions of miners over the course of the past decade. They varied in nature between the acquisition of a smaller miner by a large or mid-tier miner. Those operations may or may not have delivered on the synergy perspectives drawn.

- There have been acquisitions of explorer-developers, some of them may never have delivered on expectations while others have exceeded them.

- Finally there have been a few 'fire sales' of assets of miners that got themselves into trouble. In a few more cases the financial pit was deeper than the mining pit and no white knight showed up...

Depending on the cases depicted above, the stock market exits may have been well above their initial price for some, whereas others exits were at a loss. A few hefty losses or total losses tarnish the recent past. The 'survivor bias' cannot be more varied.

Lack of comparability

Next there are newcomers on the list, most of which were introduced with their Nov 2010 stock price. Yet many companies didn't yet exist or were very different vehicles before they were acquired by a new management in place when they were added to the database. Last but not least: the new database introductions are equally determined by the survivor bias as the remaining miners on the list.

The last such article on medium versus long term performance has been published here in 2018. Perhaps it is worth having a look just to realize how much the mining landscape has changed since.

No comments:

Post a Comment