On the gold miner pulse page of this blog, I have been pointing to the dramatic underperformance of juniors in the brutal miners swoon caused by the recent severe gold correction.

Since early April, junior miners ceased to outperform mining majors. Juniors nor majors were able to keep up with the pace of the gold price rising during summer. Whereas miners withstood a first pull back of the gold price rather well, the correction in the second half of September turned out to be dramatic. Junior miners and explorers paid a high price and much of their advantage over major miners is melting away.

Junior miner performance on that blog page is measured using the MVGDXJ index. That index is going back to end Dec-2003 and offers a relatively long perspective when compared to the GDXJ Etf itself.In an earlier posting: Junior Precious Metal Miners Outperform, an overview is given of periods of junior out-performance alternated by under-performance. The conditions under which juniors are likely to outperform are pointed out:

· Gold prices climbing steadily,

· Gold mining majors responding to the rising gold price,

· General stock markets are rising.

Gold price volatility is unfavourable for major miners as they then trim their cash flow outlook to account for possible ‘unpleasant surprises’.

Gold price volatility further compels majors to prudence while evaluating new projects: gold price estimates for future production are chosen to the safe side and a higher internal rate of return (IRR) is required. No need to explain how this holds down the valuations of their aquisition targets: promising explorers. We will need a more stable outlook for precious metal prices in order for explorer valuations to catch up.

… and yes, I know: Detour Gold is acquiring Trade Winds Ventures. But I bet that deal had been decided upon before the severe gold correction. On the flip side: Detour won’t have any difficulties in acquiring TWD: no rivalry nor any bidding war.

Stock market volatility abating would be a great thing. Speculators would be less jittery and hedge fund management would no longer be double-crossed by margin driven liquidations. A stable financial situation creates a more favourable climate for junior miners to finance their projects and for the higher valued explorers to raise capital with a more acceptable dilution for existing shareholders.

But let’s face the facts: none of the three above conditions have been met: on balance gold prices have been climbing, but volatility was dramatic. Gold mining stocks have not been responding to the rising gold price. Instead they have been lagging even more (in spite of a late August – early September recovery attempt). It is generally assumed that gold mining cash flows have soared, but as we are to see 2011Q3 results, the Q4 outlook may again be ‘on the safe side’, fully calculating in the gold price correction. No need to convince anyone: general stock market conditions have been all but rosy…

Consider it this way: junior mining stocks have necessarily been a losing hand. If you have made any money with an (exclusively long) portfolio of junior mining stocks lately, you have been extremely agile, daring, cold blooded and intelligent (or bluntly lucky).Junior gold miners lagging majors … but explorers really screw up your portfolio

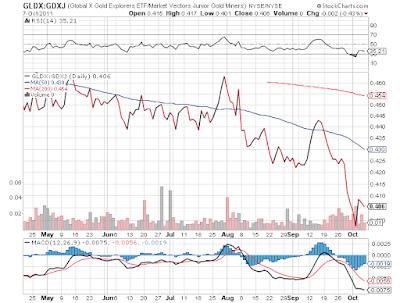

The GLDX gold explorer ETF isn’t even one year old. It made a stellar start as some explorers have been take-over targets early this year. See: GDXJ or GLDX, what to choose in the Gold Exploring Realm? As early as May 2011, it had become clear that conditions were changing. The GLDX had started to lag both mining majors and the GDXJ junior mining ETF. See: GLDX: the proof of the pudding is in the eating. The conclusion of this posting still holds in full:

Conclusion

GLDX does have its strengths and will most likely outperform as the sentiment for gold explorers turns positive. We haven’t seen any of this since mid February. Over the last few months, this ETF has been the worst choice among its peers. (...)

Consider the next part of this posting as a follow-up of the above article.In the light of the recent gold mining sell-off, you can imagine how explorers have been doing. The graphs below show the relative performance of the GLDX gold explorer ETF relative to GDX (Gold mining majors) and to the GDXJ junior mining ETF.

|

| GLDX relative to GDX. Daily observations over 6 months. Click to enlarge |

What begins bad ends worse: GLDX loses 30% relative to the GDX gold mining major ETF since late May ’11. Explorers didn’t recover after the general stock market sell-off in early August. The recent swoon of mining stocks aggravated the decline among gold mining explorers.

Even as compared to the junior mining ETF, GLDX loses 10% over the last six months. The decline relative to GDXJ has accelerated in the recent miner swoon.

Conclusion

Ignoring junior miner and explorer malperformance is about as short-sighted as just focusing on this mesmerizing fact and selling every junior position blindfolded, without even bothering to check whether the factors that drove down explorer valuation and share price, still uphold.

Headwinds for explorers have united lately, with the three adversities coinciding: a situation which is unlikely to continue very long. Sell only if you need to, pray for better if you hold on, buy if you dare to.

|

| GLDX relative to GDXJ. Daily observations over 6 months. Click to enlarge |

Conclusion

Ignoring junior miner and explorer malperformance is about as short-sighted as just focusing on this mesmerizing fact and selling every junior position blindfolded, without even bothering to check whether the factors that drove down explorer valuation and share price, still uphold.

Headwinds for explorers have united lately, with the three adversities coinciding: a situation which is unlikely to continue very long. Sell only if you need to, pray for better if you hold on, buy if you dare to.

The gold price is not resistant to the effects of economic and financial markets swings, according to the report from the global gold market development organization Gold’s volatility is considerably more stable .

ReplyDeleteEconomic Stability

I high appreciate this post. It’s hard to find the good from the bad sometimes, but I think you’ve nailed it! would you mind updating your blog with more information? best gold stocks to buy

ReplyDelete