The April article pointed to catalyser metals losing their speculative premium. Palladium has been over three times more expensive than platinum after the former recovered rapidly after the dip during the Covid pandemy frenzy.

Only a modest premium of Palladium over Platinum was left in April and an update early May showed a first timid price inversion. A price inversion doesn't mean anything if it cannot hold. Sometimes it is a signal for speculators to unload on the metal getting stronger and buy the metal seemingly 'on sale'.

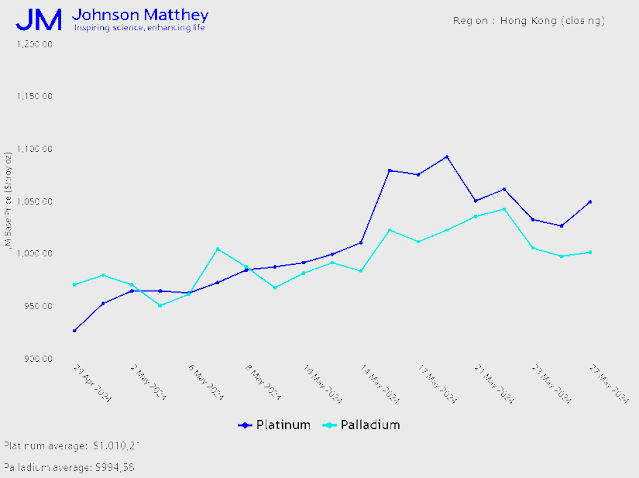

If a price inversion does hold, it is only a matter of time before the monthly average also inverts. This is where we are right now:

|

| Johnson Matthey daily data for Palladium (light blue) and Platinum (dark blue) |

As before, we have chosen the Johnson Matthey daily data for Palladium (light blue) and Platinum (dark blue). The price trend of platinum was upward over the first two weeks, while Palladium bounced up and down.

The Palladium premium over Platinum narrowed down by the end of April and a first price inversion appeared early May. Since May 9, Johnson Matthey has been quoting platinum constantly above Palladium on their daily average sales data.

By now the montly average of Platinum ($1010.2 /Oz) is also above the monthly average of Palladium ($994.58 /Oz). This implies the end of a price anomaly which has held for close to seven years: since late September 2017.

No comments:

Post a Comment