Monetary largesse and ballooning public debt have been fueling the growth of the money supply. As a result, the fiat based monetary system has been experiencing its first inflationary surge in the 21st century. What does the future hold for the monetary system? Macroeconomic imbalances and geopolitics may accelerate change in the current largely USD-based monetary system into a more multipolar one.

Since its

launch in 1944, the USD-centric monetary system has undergone radical change,

typically in response to "systemic" crises such as major shifts in US

monetary policy that generated stresses outside the United States.

In recent

years, the changes in the global economy, economic policy responses, and the

geopolitical situation have triggered hefty reactions in financial markets,

including money, bond, and foreign exchange markets. They have also raised the

question as to whether the international monetary system may be subject to more

long-term and fundamental changes.

In which

direction is the monetary system heading?

It seems as if a gradual evolution to a more multipolar monetary system is the most probable outcome, with a more extreme turn away from the USD-centric system being much less likely.

Two unlikely scenarios: A common global currency or a different currency hegemon

1. Creation

of a common global currency remains illusory

Proposals

for a world currency have not materialized and, in the current geopolitical

setting, are now even less likely. Put simply, handing over the power to print

money from your own central bank to a supranational authority requires enormous

mutual trust among countries and an intensely cooperative geopolitical

environment.

2. Lack of

an alternative currency hegemon

How about a

currency other than the US dollar to take on a similarly dominant role in the

global monetary system?

There are

two regions that are similar in economic size to the United States, and which

by their scale might in principle qualify: the euro zone and China.

Euro zone

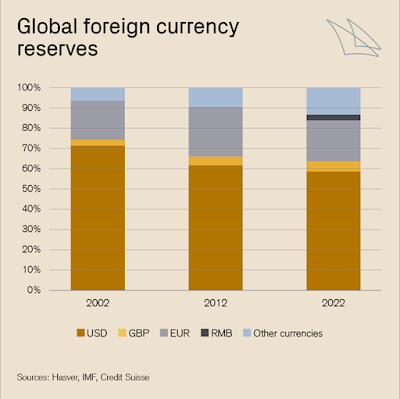

The euro

now accounts for around 20% of global FX reserves – the second largest share

behind the US dollar – and is also freely tradable across borders. And yet,

euro zone policy makers are clearly not striving for their currency to take on

such a role; indeed the focus of the European Central Bank (ECB) remains very

much on the domestic economy.

Alternatives

The

creation of a truly new global currency, or the rise of an alternative

"hegemonic" currency is, in our view, very unlikely in the

foreseeable future.

So, what

might a future monetary system look like in the absence of either a new world

currency or a full replacement of the US dollar as the lead currency?

Gradual

evolution of a more multipolar system

Essentially

we see a new, more multipolar system evolving as a result of four drivers:

1. the

trend increase in bilateral trade among many countries, allowing for returns to

scale in the use of their respective currencies rather than the US dollar;

2.

deepening of local capital markets in emerging markets;

|

Transactions

in emerging market currencies are on the increase; Source:

BIS, Credit Suisse |

Since the

financial crisis of 2008 we have seen efforts to increase the robustness of the

monetary system and better protect emerging markets from the stresses that

arise from the US dollar-centric system.

This means

the world has gradually been moving toward a more multipolar currency system.

The question is whether this process will continue in a fairly smooth manner,

or whether we might see abrupt moves in one or the other direction.

This blog article is anchored on what is available in the press release of the extended report with the same title. You can read the press release and download the report on this Credit Suisse Research page.

No comments:

Post a Comment