From September until the end of the year is repeated over and over to be the seasonally strongest period of the year for precious metals. Such statistics however are averages and calculated standard errors are considerable. Yet we now face the fourth consecutive year with gold selling off during autumn. Could we do any better investing in any other precious metal ?

It is most common to compare gold to any other precious metal through e.g. a Gold-to-Silver, or Gold-to-Platinum ratio. This tells you how many ounces of the second precious metal one ounce of gold would buy.

Well over two months ago, a first blogpost was dedicated on this subject and after the latest gold sell-off, it is useful to repeat the exercise.

We start off in 2011: As silver is challenging the 1980 all time high, its rapid rise in spring 2011 leaves gold behind, though the yellow metal is itself in an uptrend. Early May 2011 silver drops out of its parabolic rise and the gold to silver ratio (GSR) abruptly jumps up from a low at 31.4 (Apr 27) to a high at 45 (May 12) in only two weeks time. As gold makes its all time high with a double top in August/September 2011, silver has been climbing out of its June 2011 low to about $43/Oz. The GSR holds firm near 45. Yet the gold sell-off later in autumn 2011 is detrimental for silver also. The white metal drops to near $28 as gold sells off to $1615, making the GSR jump abruptly to over 57 as early as Sept 26, 2011. An ounce of gold buys over 80% more silver than it did 5 odd months earlier! Silver being called "gold on steroids" indeed seems to have a whim of truth in it. During the gold spring rally, silver outpaces gold once more, making the GSR fall to 48 on Feb 29, 2012. Leap day also means the end of that rally. Again over 2013 we clearly distinguish the late June gold sell-off, whereby silver once again leverages gold to the down-side. GSR peaks above 66 on June 27, 2013. Some more swoons and recoveries later, we now face the GSR at 74: barely below its early July peak (77). A comparable GSR was last seen in the summer of 2009 and we need to return to the latter part of the financial crisis (January 2009) to find GSR values substantially higher than the present.

In November 2008 the GSR peaked at 84, with however few readings above 80. I might conclude with the same statement as last time: There is so far not the least indication of any meaningful turn-around on the chart. Yet I start wondering if the GSR still has left any leeway from its current level. Silver now is structurally undervalued relative to gold to a level which only is justified if industrial demand were to slide. Even with growth in the US less vigorous than anticipated and most of Europe and Japan leaving behind a recession, we are far from the catastrophe scenario of late 2008, expecting the complete world economy to come to a grinding halt.

The 'swing producers' with a more substantial revenue from silver mining, have a harder time. Those having hedged part of their production volume at better prices, may still thrive. Several 'swing producers' also have substantial secondary production of other non-ferro metals. This may somehow buffer the slide of their earnings.

Since there is no firm price-constraint for silver production, this means that a meaningful drop in industrial demand may prolong the protracted downtrend of the silver price. At the other side it also implies that increased industrial demand and higher silver prices are not readily met with any significant increase of mine production. Only the 'swing producers' may crank up production if feasible.

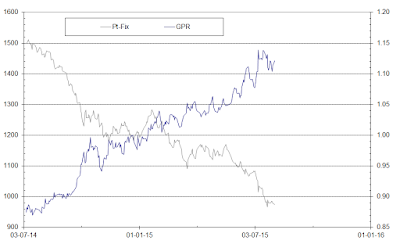

The above graph shows platinum in USD/Oz on the left scale and the GPR on the right scale. As the sovereign debt crisis escalates in Europe, the economic recovery since 2009 comes to a grinding halt. Stock markets correct and Europe slides in a recession. Especially the automotive industry (through the catalytic exhaust filters one of the most important consumers of Platinum and Palladium) is having a hard time and cuts its production volume. Several car manufacturers are even closing down plants in Europe. The outlook is most bleak. The slide of the platinum price in autumn 2011 makes the GPR jump abruptly above one. During the financial crisis the GPR briefly touched 1, whereas the GPR had been trending lower before. Platinum however has little in common with many other industrial commodities, where a drop in price makes demand rise significantly. It is on the contrary the supply side getting deep into trouble. Violent strikes erupted at Lonmin's Marikana mine in South Afirca, the most important platinum producer. This only made platinum rise temporarily and shortly bring the GPR down to 1. As the crisis cooled down, platinum prices fell back till way into summer 2012: the GPR quoted above 1 for an extended period. It required above ground supplies running low to make platinum recover to $1700 later in 2012.

Despite precious metals selling off in triple selling spree during 2013, nor the April, nor the June nor December dips for gold are matched by platinum dropping lower. On the contrary, the GPR systematically drops below 1 from the second quarter onward. In 2014 the GPR twice tested the 0.85 resistance (on Jan 20 and May 30). Though platinum prices left behind the 2013 support level of around $1320, they had a hard time breaking above $1500/oz.

The situation deteriorated abruptly since early September 2014. Whereas the USD recovery plays a role in the weakening of raw materials across the board, there is more at hand for platinum. A new recession in many European economies was worsening the demand outlook from the car industry. At the same time, platinum is selling off in tandem with palladium. However palladium has reached a twelve year high in August 2014, whereas platinum never even came near its $2270 top level, dating from March 2008. On Oct 6, the platinum price plunged to a five year intra-day low at $1190 to end the day recovering to a higher close... and yet worse was to come.

The November platinum slide brought the GPR near one again. However, when the GPR peaked above 1.15 in 2012, the platinum price bottomed barely below $1400. In the nascent January gold recovery, platinum was unable to keep pace with the rising price of the yellow metal. The GPR broke above 1 by mid January 2015. At the other hand, the latest sell-off in precious metals has been well matched by further weakening of Platinum, sliding to another multi-year trough below $1100 on March 17. The latest July slide brought platinum back to triple digit prices in USD, with the GPR peaking at 1.14 by mid July.

During the strike at Lonmin's Marikana mine, processing of a stockpile of ore could make the company meet its delivery obligations. It is unsure whether Lonmin yet managed to rebuild inventory to cope with any possible interruption of ore supply.

The current demand for platinum is in excess of 250 tonnes per year, of which the car industry consumes about 120 tonnes. The yearly shortfall needs to come from platinum recycling, mainly from spent catalytic convertors. Palladium/Platinum recycling is a more profitable business than mining. Companies involved are Johnson Matthey and Umicore.

The price of palladium always has been lower than that of platinum, but it does vary quite a lot. Until the 1990's, Russia had a stockpile of palladium, coming from the Norilsk nickel mine. As that supply got nearly exhausted, there has been a speculative surge of palladium to above $1000/oz early in 2000. Palladium dropped back to below $200/oz during the 2002-03 economic crisis. A history in brief, but we now focus on 2011-14 as we did for the other precious metals.

The profile of the graph is much similar to that of platinum. The gold to palladium ratio (GPdR) starts off quite low (high Pd prices) in 2011 and like platinum the price of palladium also heavily suffers during the sovereign debt crisis and the stock market correction in 2011. Palladium lagged as gold made its all time high and then fell off a cliff as the yellow metal retreated in autumn 2011. From below 1.75 the GPdR approached 3 as Pd bottomed near $550/oz. Palladium weakness lingered on a while longer than did platinum. In autumn 2012 the GPdR still stood around 2.75. After palladium started rallying by towards the end of that year, its price level remained remarkably resilient during 2013 as gold plummeted in three sell-off waves. Lately, palladium has been rallying much more than did platinum. Unlike platinum, its price in August was at a more than 12-year maximum, higher than in January 2011 and the GPdR has dropped to test and break the 1.5 level a few times.

Worsening of the economic outlook, mainly because of most of Europe entering another recession has driven down palladium prices from their recent highs. Most of the 2014 gains have been wiped out in less than two months. However, unlike for platinum, current palladium prices still are materially stronger than what they were at for over a year: from autumn 2011 till year-end 2012. Moreover, palladium kept up better than other precious metals during last mid December slump. It however seems to pay the price for its running ahead of the pack: palladium entered into a counter-trend slide while gold strengthened around mid January 2015. In a tight market, there was little reason for this slide to persist. We indeed withnessed Palladium strengthening with gold giving way below its $1180 support. Mid March 2015, the GPdR dropped below 1.5. Palladium recently was off for some profit taking as its slide has been outpacing that of other precious metals. After a $200 slide year-to-date, palladium now quotes below $600 and the GPdR has risen above 1.75.

It is most common to compare gold to any other precious metal through e.g. a Gold-to-Silver, or Gold-to-Platinum ratio. This tells you how many ounces of the second precious metal one ounce of gold would buy.

Well over two months ago, a first blogpost was dedicated on this subject and after the latest gold sell-off, it is useful to repeat the exercise.

*** Graphs last updated on Aug 03, 2015 ***

After we've seen the bottom of the precious metal bear market, a new article on this subject has been published: Platinum; Palladium and Silver relative to Gold (March 2016)

Silver still out of favour

If gold has been selling off badly into December 2014, the silver slide was horrendous. As a result, the Gold-to-Silver ratio (GSR) has been rising. Is this part of a trend or just a temporary surge of the GSR? |

| Silver fix in pale (LME in USD/oz) on the left scale and gold-to-silver ratio (GSR) in dark on the right scale (click to enlarge) |

In November 2008 the GSR peaked at 84, with however few readings above 80. I might conclude with the same statement as last time: There is so far not the least indication of any meaningful turn-around on the chart. Yet I start wondering if the GSR still has left any leeway from its current level. Silver now is structurally undervalued relative to gold to a level which only is justified if industrial demand were to slide. Even with growth in the US less vigorous than anticipated and most of Europe and Japan leaving behind a recession, we are far from the catastrophe scenario of late 2008, expecting the complete world economy to come to a grinding halt.

The supply equation

It is generally known that as much as 70% of the silver mined is produced as a secondary output stream from other non-ferro metal miners. Silver most often is found either in combination with lead, zinc and tin or else combined with copper. Their production is little or not sensitive to the silver price and they will continue producing while they have off-take for their primary copper or lead. Most often, non-ferro miners have hedged their silver output or have sold the stream against investment financing. In the latter case they are selling silver at marginal production cost. [There also are several gold miners having a silver secondary output stream, yet their contribution is far smaller than the former ones.]The 'swing producers' with a more substantial revenue from silver mining, have a harder time. Those having hedged part of their production volume at better prices, may still thrive. Several 'swing producers' also have substantial secondary production of other non-ferro metals. This may somehow buffer the slide of their earnings.

Since there is no firm price-constraint for silver production, this means that a meaningful drop in industrial demand may prolong the protracted downtrend of the silver price. At the other side it also implies that increased industrial demand and higher silver prices are not readily met with any significant increase of mine production. Only the 'swing producers' may crank up production if feasible.

Platinum: an abrupt worsening of the outlook

Platinum is our next focus. The Gold to Platinum ratio (GPR) has been discussed on a very long time frame in a previous blog post: Platinum group metals: a story of scarcity and industrial needs. The long term graph therein has been updated to include data as of Mar 16, 2015. We now repeat the above exercise from the beginning of 2011 onward for platinum. |

| Platinum fix in pale (LME in USD/oz) on the left scale and Gold to Platinum ratio (GPR) in dark on the right scale (click to enlarge) |

Despite precious metals selling off in triple selling spree during 2013, nor the April, nor the June nor December dips for gold are matched by platinum dropping lower. On the contrary, the GPR systematically drops below 1 from the second quarter onward. In 2014 the GPR twice tested the 0.85 resistance (on Jan 20 and May 30). Though platinum prices left behind the 2013 support level of around $1320, they had a hard time breaking above $1500/oz.

The situation deteriorated abruptly since early September 2014. Whereas the USD recovery plays a role in the weakening of raw materials across the board, there is more at hand for platinum. A new recession in many European economies was worsening the demand outlook from the car industry. At the same time, platinum is selling off in tandem with palladium. However palladium has reached a twelve year high in August 2014, whereas platinum never even came near its $2270 top level, dating from March 2008. On Oct 6, the platinum price plunged to a five year intra-day low at $1190 to end the day recovering to a higher close... and yet worse was to come.

|

| Gold to Platinum ratio over 10 months: the almost continuous platinum slide is far worse than that of gold. |

Supply - demand balance

Platinum prices are too low for production to be profitable in most of the South African mines (by far the largest platinum producer world-wide). Revenues may suffice to pay for current expenses and personnel costs, they don't allow the capital expenditure needed to sustain platinum production at the current level. Adding ore reserves to assure the production level for some years to come is out of the question. With a world-wide production short of 200 tonnes (less than 8% of the yearly gold production), platinum is an extremely tiny market. Unlike gold, for which the above ground supply meets yearly consumption many times over, the supply of refined platinum only covers the industrial demand for several weeks to a few months.During the strike at Lonmin's Marikana mine, processing of a stockpile of ore could make the company meet its delivery obligations. It is unsure whether Lonmin yet managed to rebuild inventory to cope with any possible interruption of ore supply.

The current demand for platinum is in excess of 250 tonnes per year, of which the car industry consumes about 120 tonnes. The yearly shortfall needs to come from platinum recycling, mainly from spent catalytic convertors. Palladium/Platinum recycling is a more profitable business than mining. Companies involved are Johnson Matthey and Umicore.

Palladium: heavily selling off from recent high

The last metal in the row is palladium. This metal has many properties in common with platinum. Its main use is in catalytic exhaust filters for gasoline engines. Palladium is less used in electronics than is platinum. The metal often is found in conjunction with platinum.The price of palladium always has been lower than that of platinum, but it does vary quite a lot. Until the 1990's, Russia had a stockpile of palladium, coming from the Norilsk nickel mine. As that supply got nearly exhausted, there has been a speculative surge of palladium to above $1000/oz early in 2000. Palladium dropped back to below $200/oz during the 2002-03 economic crisis. A history in brief, but we now focus on 2011-14 as we did for the other precious metals.

|

| Palladium fix in pale (LME in USD/oz) on the left scale and Gold to Palladium ratio (GPdR) in dark on the right scale (click to enlarge) |

Worsening of the economic outlook, mainly because of most of Europe entering another recession has driven down palladium prices from their recent highs. Most of the 2014 gains have been wiped out in less than two months. However, unlike for platinum, current palladium prices still are materially stronger than what they were at for over a year: from autumn 2011 till year-end 2012. Moreover, palladium kept up better than other precious metals during last mid December slump. It however seems to pay the price for its running ahead of the pack: palladium entered into a counter-trend slide while gold strengthened around mid January 2015. In a tight market, there was little reason for this slide to persist. We indeed withnessed Palladium strengthening with gold giving way below its $1180 support. Mid March 2015, the GPdR dropped below 1.5. Palladium recently was off for some profit taking as its slide has been outpacing that of other precious metals. After a $200 slide year-to-date, palladium now quotes below $600 and the GPdR has risen above 1.75.

Conclusion

Despite the repeated gold sell-off from September 2014 onwards, the yellow metal is down less than are silver or platinum. The silver slide is the succession of a lengthy period of silver structurally lagging gold. The GSR now lingers on around 72, barely below its five year high at 76.

Both platinum and palladium have been sliding more than did gold since the top in summer 2014. However this is not the culmination of a long-term trend. It's important to distinguish platinum, which recently made another five year low, and palladium which only sold off from a more than twelve year high and still quotes at materially stronger prices than three to two years ago.

Save gold online “A little savings today, makes a better tomorrow”

ReplyDelete