Ultimately the broad stock market rally ran out of steam. The S&P retreated from its all time high and now is back to 1982.8. Not that this makes any difference for precious metals. After another rocky week, the metals end mixed. Since Friday Sept 19, Gold is almost flat, while silver is down 0.7% over the week. After the lowest close since several years at $17.5 on Thursday, there is a timid recovery to end the week with. Main victim is Palladium ($772), which sold off quite rapidly after its recent multi-year high above $900. Platinum is taken down in the slipstream to $1297, with the gold-to-platinum ratio now up to 0.94 once again.

|

| How Palladium lost all of its gain since end March (leading up to its multi-year high) in just one month (click to enlarge) |

Goldminers

The HUI index barely holds above 200, closing at 201.7 on Friday. This is below the 205, where we closed on the first 2014 trading day. We are back to square 1.

|

| ARCA index of unhedged gold miners (symbol: HUI), since bottoming in December 2013 (click to enlarge) |

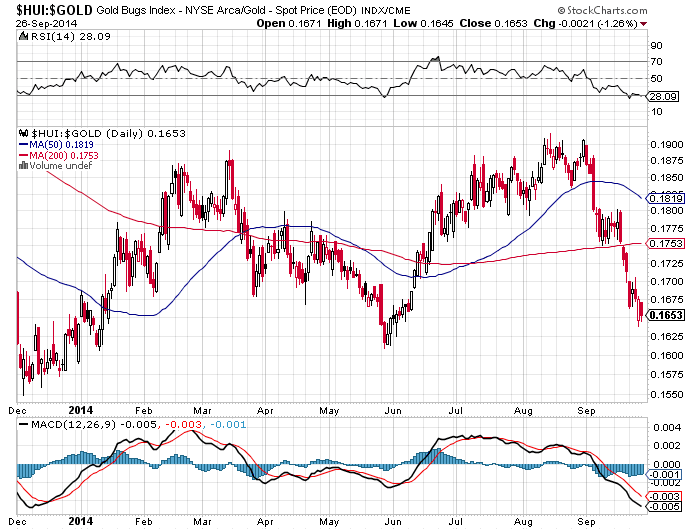

The HUI is most often shown relative to gold bullion. HUI/gold is down to 0.1653: we are almost back to the level of end May 2014, before the June gold recovery set in.

|

| HUI/Gold, daily observations over six months (click to enlarge) |

This also implies that 75% of the gains from the December 2013 bottom at 0.157 to the recent August peak at 0.19 have been lost, as shown in the graph below:

|

| HUI/Gold, daily observations since the December 2013 bottom (click to enlarge) |

Silverminers

With silver down 10% year-to-date, this almost must be catastrophic for silver miners. Yet silver miners share the same misfortune as gold miners: all 2014 gains have been wiped away, but no fresh bottoms were set. The below graph shows the Global X silver miners ETF since December 2013: |

| SIL, the Global-X silver miners ETF, daily observations since the December 2013 bottom (click to enlarge) |

Like for the HUI relative to gold, we now show the graph of SIL, relative to silver bullion over the same time frame:

|

| SIL/Silver, daily observations since the December 2013 bottom (click to enlarge) |

Relative to silver, SIL upheld much better than did the gold mining majors. SIL/Silver retains a substantial part of its 2014 gains, though it recently plunged below both its 50 dma (Sept 2) and its lower 200 dma (Sept 19).

Selecting Explorers and Juniors Miners

On the Turd Ferguson Metals forum, I maintain a thread where the contributor driven explorer & junior miner spreadsheet is discussed weekly. The thread is named "Selecting explorers and junior miners". The thread is the follow-up of a 2012 blog post with the same name. (To read this, click here).

With platinum group metals beaten up, the worst can be expected for our contributor driven explorer & junior miner spreadsheet. However the weekly loss is contained to 3.63%, in line with the 3.26% loss on the HUI index and less bad than both GDXJ (-4.3%) and GLDX (-4.5%) benchmarks. We now are down to an aggregated loss of 39.24%.

Over the week, 7 picks are up, against 15 down with the three remaining flat. Oceana Gold leads to the upside: recovering after last week's slide. Asanko Gold, Pilot Gold and (predictably) Platinum metals group (PLG) lead to the downside with a double digit loss.

With junior miners and explorers beaten up the way they are, the stage is set for a recovery, which will blow life into this sector again. For this play, a time schedule is never released. Be sure to have your seat reserved. As the bell rings it will be more expensive to make arrangements.

The magnitude of the loss incurred (gold explorer ETF GLDX is down more than 75% over the same time frame, while GDXJ shed 73%) sets a potential target. However this never has been, nor can be a straight line up, as the two failed recoveries in 2014 have shown.

No comments:

Post a Comment